The scaling challenge for SMR startups

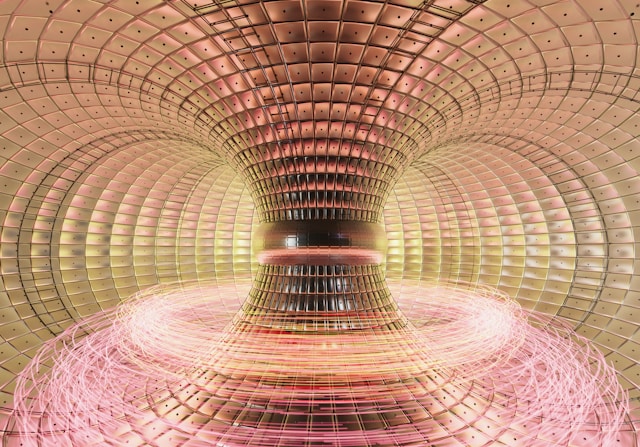

SMRs have become one of the most closely watched frontiers in energy innovation. Their promise is compelling: faster deployment, modular construction, enhanced safety features, and the ability to bring nuclear power into markets and applications where gigawatt-scale reactors are impractical. For governments, investors, and utilities, SMRs represent both a climate solution and a strategic opportunity.

Yet, behind the optimism lies a stark reality. Most SMR developers today are still startups—lean, engineering-driven ventures with limited resources. The real challenge is not designing reactors on paper or in laboratories, but scaling from R&D entities into fully fledged industrial companies capable of delivering reactors at commercial scale. This transition is proving to be far more difficult than anticipated, defined by what energy analysts call the “valley of death”: the high-risk, capital-intensive gap between proving a concept and deploying a first-of-a-kind facility.

The funding gap between startups and infrastructure

The financing model for SMRs exposes a fundamental tension. Startups typically attract venture or growth equity in their early phases, raising tens or even hundreds of millions to fund design, licensing, and initial prototypes. Recent years have seen several SMR companies successfully expand their capital base, underlining investor enthusiasm for nuclear innovation.

But the leap to actual deployment requires billions, not millions – French government released a study claiming that at least €1b is necessary to reach FOAK deployment. FOAK projects carry the financial profile of large infrastructure assets and require sufficiently large balance sheets. Yet, unlike other industries, SMR startups cannot generate significant revenues until reactors are fully licensed and operational—a process that often spans a decade or more. This creates a prolonged period where capital is consumed but no income is generated, eroding investor confidence. Nuclear projects are uniquely capital-intensive and require patient, long-term financing that few private investors are accustomed to providing. To that effect, decision makers have been trying to counter this challenge that scares away investors through innovative financing structures such as the Regulated Asset Based model (RAB) for Sizewell C.

Without bridging mechanisms, many developers risk being stranded in this financial dead zone. The valley of death is therefore not a metaphor but a structural problem: a stage where enthusiasm is high, technical potential is proven, but funding dries up because the scale of capital required resembles traditional infrastructure rather than high-growth technology.

Policy and licensing as strategic gateways

Scaling SMRs is not just a financial challenge; it is also profoundly shaped by policy and regulation. Licensing remains one of the most significant bottlenecks. Most regulatory frameworks were developed for gigawatt-scale reactors, with little flexibility for modular or novel designs. The result is that many SMR projects face lengthy and uncertain approval processes that extend timelines, inflate costs, and deter investors.

The IAEA has underscored the importance of regulatory innovation, calling for harmonization of standards across countries to avoid duplicative and inconsistent licensing processes. Similarly, the OECD-NEA stresses that governments must adapt existing frameworks to reflect the specific risk profiles of modular reactors. Without more agile regulation, SMRs risk being trapped in a cycle of endless review and delayed deployment. Hence the presidential executives orders and the U.S. DOE pilot programme, aiming at accelerating SMR deployment through simplified regulation.

Policy also directly shapes market appetite. A recent analysis showed that investor confidence is closely correlated with government signals—long-term decarbonization commitments, procurement frameworks that recognize nuclear as a clean energy source, and public funding for FOAK deployments. Where policy is clear and supportive, private capital follows; where it is inconsistent, projects stall.

Industrial supply chains and execution capability

Even if financing and licensing are secured, SMR startups confront the industrial reality of scaling. Building a reactor requires an ecosystem of advanced suppliers: forged steel, precision machining, nuclear-grade materials, modular construction expertise, and digital control systems. Few startups have this capacity internally. To succeed, they must form strategic partnerships with established industrial players or build entirely new supply chains from scratch. Identifying relevant delivery models is essential. Away from the traditional EPC model or Multi-Package, there are collaborative alternatives such as Integrated Project Delivery (IPD) that can bring stakeholders engagement and lower risks.

Some companies are already innovating in this space. Thorcon, for example, leverages the shipbuilding industry, constructing reactors in established shipyards before transporting them to deployment sites. This “shipyard build” approach reduces on-site construction risks, exploits existing industrial expertise, and demonstrates how cross-sector synergies—in this case with shipping—can accelerate nuclear deployment.

Yet the challenge is systemic. Industrialization is the decisive bottleneck. SMRs cannot remain bespoke projects; they must evolve into standardized, replicable products. This requires not just new engineering, but new manufacturing paradigms that treat reactors as products rather than one-off megaprojects.

Organisational scaling and talent pressures

The human capital dimension is equally significant. Most SMR startups today are composed of small teams of engineers, scientists, and business developers. Scaling to become an industrial company means managing thousands of employees, complex vendor networks, and multinational project pipelines. This organizational transformation is as demanding as the technology itself.

The IAEA consistently highlights the need for human resource planning in nuclear programs, noting that gaps in project management and specialized engineering often cause delays. SMR startups must therefore not only attract scarce nuclear talent but also build governance structures, training programs, and cross-generational knowledge systems capable of sustaining long-term industrial operations. In a sector already facing widespread skills shortages, this is no small task.

FOAK to NOAK: the cost curve challenge

Perhaps the most defining test of all is the transition from FOAK to Nth-of-a-Kind reactors. FOAK projects inevitably come with high costs, technical risks, and uncertain schedules. It is only by achieving NOAK deployments—where repetition, learning effects, and standardization drive down costs—that SMRs can become commercially viable and display competitive Levelized costs of Electricity or LCOEs.

FOAK may be as expensive per megawatt as large reactors, but costs decline steeply once manufacturing and deployment routines are standardized. The challenge is ensuring that startups, investors, and governments can sustain commitment through this critical phase. Without reaching NOAK, SMRs risk remaining perpetually experimental.

Investor confidence and the long game

For investors, SMRs present both an opportunity and a dilemma. The potential market is vast—tens of billions in new capacity across developed and emerging economies—but the timelines, risks, and policy uncertainties are daunting. A recent CNBC review of U.S. SMR efforts illustrates the paradox: enthusiasm is high, yet FOAK facilities face cost overruns, regulatory delays, and investor hesitation. Not only seen in the U.S., this is a world-wide situation.

To overcome this, blended financing models are emerging, combining public funding, export credit, institutional capital, and strategic partnerships with large industrial firms. The SMR deployment will succeed not just on technological merit, but on the strength of governance and financing innovation. Investor confidence depends on credible roadmaps, transparent risk-sharing mechanisms, and evidence that lessons from FOAK projects are being systematically applied to subsequent deployments.

From startups to industrial champions

The journey from startup to industrial champion in the SMR space is arduous, but the stakes could not be higher. Developers must secure patient capital that bridges the gap between venture finance and infrastructure-scale funding. They must work with governments to ensure regulatory frameworks are fit for purpose. They must build or integrate into robust industrial supply chains, while simultaneously scaling their own organizations and workforce capacity. Above all, they must prove they can deliver FOAK projects and quickly transition to standardized NOAK deployments.

The challenge is formidable, but the prize is historic. If successful, SMR startups will not only carve out a new industrial niche, they will redefine how nuclear power is delivered—making it more modular, more scalable, and more integrated into the broader energy transition. The companies that manage to cross the valley of death will become the backbone of a new era in nuclear, shaping both climate resilience and industrial competitiveness for decades to come.